It is very important to understand different types of candles in the Stock market so that we can take the right decision. The best way to understand this is to study the price movement in the candlestick chart and draw conclusions accordingly. Since market experts have already written and said a lot about such candles. We will learn them one by one. If you are a trader and want to improve your analysis, it is important to understand different candles. In this guide, we’ll explore the various candle formations.

What Are Different types Of Candles in the Stock Market?

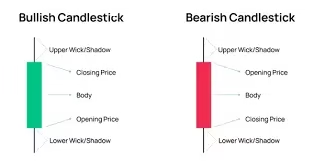

Before going into the depth of different types of candles in the stock market, let us briefly understand what a candlestick is. Candlesticks represent price movement in a specific time frame (minutes, hours, days or weeks). It has a rectangular body and wicks(shadow). The rectangular body of the candle represents the opening and closing price while the wicks represent the highest and lowest price within our time frame.

Candlesticks are very important to understand the price movement. These help us predict potential price trends. These candles together form a pattern which is known as a chart pattern. Traders spot these chart patterns which indicate future market movement. Let’s take a closer look at the images of different types of candles in the stock market.

1. Bullish Candles In The Stock Market

A bullish candlestick indicates advancement in the asset price within the time frame. It generally has a filled body where the closing price is higher than the opening price. Such candles suggest buying pressure and are closely associated with a generally bullish market.

Bullish candlesticks may represent a buying opportunity especially when they appear after the period of consolidation. Traders may pay attention to such candles to take long positions for anticipation of price rise.

2. Bearish Candlestick

Opposite to a bullish candlestick, a bearish candlestick shows decrease in the asset price during a trading period. In this type of candle, the closing price is lower than the opening price. Such candles generally indicate selling pressure. Bearish candles are often seen during a down trend.

When the price action shows momentum decline, the bearish candle indicates the exit of the long position or signals the entry point for possible short selling.

3. Doji Candlestick In The Stock Market

It is one of the different types of candles in the stock market. Doji candlestick is formed when there is indecision in the market meaning neither there is bullish nor there is bearish sentiment. In such candles mostly there are long wicks and the body is equal to negligible because the opening price and closing price are the same .

If a Doji candle appears after a strong trend, it signals a potential reversal or indicates that the momentum is slowing down and the direction of the trend may change.

4. Hammer Candlestick

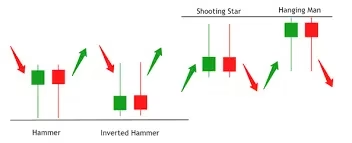

It is another kind of different types of candles in the stock market. Hammer candlestick generally appears after a downtrend. It is a type of bullish reversal candle in which one side wick is very large. The wick should be at least three times the body for an ideal hammer candlestick. The body of the Hammer candlestick is very short. Such candles are formed when there is selling pressure and the price goes down quite a lot so that the buyer is successful in bringing the price back to the opening price.

When these appear after a long downtrend, they signal that a price reversal is about to occur, which is an ideal entry point for creating long positions.

5. Hanging Man Candlestick

Hanging man candlestick is similar to hammer candlestick but it generally appears after the uptrend. The meaning of this candle is the opposite of the hammer candle i.e. this candle indicates a bearish reversal.

6. Engulfing Candlestick Patterns

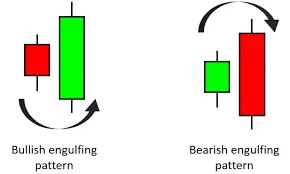

Engulfing candlesticks are of two types: bullish engulfing and bearish engulfing. Bullish engulfing pattern is formed when a small bearish candle is engulfed by a larger bullish candle i.e. the body of the larger bullish candle is large enough to easily engulf the small bearish candle. Such a pattern indicates bullish sentiment in the market.

Second bearish engulfing is formed when a small bullish candle is covered by a larger bearish candle i.e. engulfs it in its body. Such patterns indicate bearish sentiment in the market.

7. Marubozu Candlestick

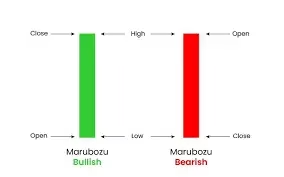

Marubozu candlestick is one of the different types of candles in the stock market. It is a strong candlestick that has no wick. These candlesticks are of two types: bullish bearish and bearish bearish. Bullish Marubozu is formed when the opening price is equal to the low of that trading period and closing price is equal to the high of that trading period. This indicates a kind of strong buying pressure.

Bearish Marubozu is formed when the opening price is equal to the high and closing price is equal to the low of that trading period. This signals strong selling pressure.

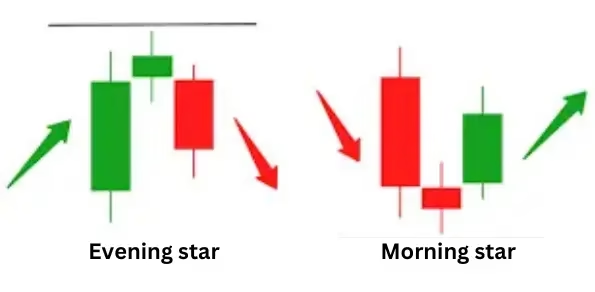

8. Morning Star And Evening Star

Morning star pattern is formed when a long bearish candle is formed followed by the formation of a Doji candle and after that a long bullish candle is formed. These three candles together form a morning star. If such a pattern appears after a long downtrend it indicates a bullish reversal.

Evening star pattern is formed when a long bullish candle is formed followed by the formation of a Doji candle and after that a long bearish candle is formed. If such a pattern appears after a long uptrend it indicates a bearish reversal.

Conclusion

It’s imperative to grasp the various candle types in the stock market if you want to become an expert in technical analysis. Every formation of candlesticks is a tale in itself about the attitude of the market, and when put together with other indicators, helps one make sound decisions. If you are working with FirstRaid or any other trading platform, identifying different types of candles in the stock market and what they mean can provide an advantage in the stock market. From bullish candles predicting uptrends to Doji candles forecasting indecision, the ability to read candlestick patterns will vastly enhance your trading approach.

Read more: What is Nifty and Sensex?

[…] Read more: Different types of candles in stock Market […]