Stock Market Crash in 2025? – Insights by Firstraid

Will the stock market crash in 2025? This question is causing a lot of concern and discussion among investors. The rise and fall in the stock market is part of the market cycle. But as we approach March 2025, it becomes important to look at various market factors so that we can understand how likely a market crash is and how we should prepare for it so that we can manage our possible losses.

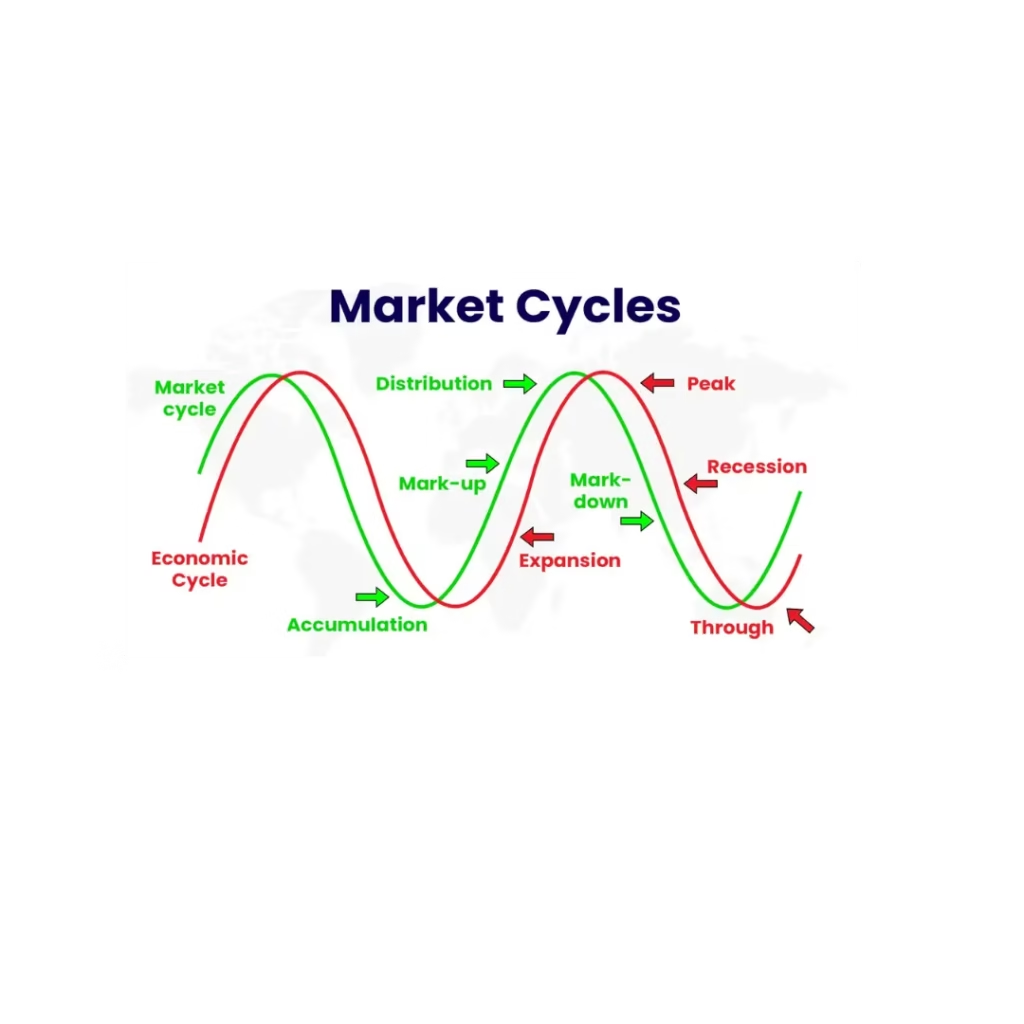

Understanding the Stock Market and Its Cycles:

Stock market moves in cycles in which there is a situation of growth, stagnation, and decline. Historically, the market includes bull market (which is a period of increase in the share price) and bear market (which is a period of decline). A stock market crash occurs when the market falls very rapidly, due to sudden changes in economic conditions. We are experiencing a downward trend, but at the same time, we have also seen growth in the market after recovering from the recession caused by the stock market crash of 2020. Although it is difficult to say this, but we should pay attention to some such factors which can affect our market in the next few years.

Economic Factors to Watch:

1.Inflation and Interest Rate

Inflation has become a matter of concern in the last few years, especially after the pandemic. When central banks like the Reserve Bank of India increase interest rates, the cost of borrowing also increases. Recently, consumer spending and business investment have slowed down. This is why we have seen a decline in urban consumption, which is a major part of India’s GDP. To address this problem, the Indian government has proposed zero tax on income of Rs 12L in this last budget so that consumption can be boosted.

2.Global Geopolitical Tensions

Geopolitical tension & political scene also play an important role in the stock market crash or its stability. For some time now, Russia – Ukraine war and Israel-Hamas war have done enough to cause inflation and disrupt the supply chain. Due to this we see that the Recession has made its debut in most of the countries of the West, its negative effects are being seen in the rest of the world.

3.Corporate Earnings

There has been a decline in the profits of companies in the last two quarters i.e. Q2 and Q3, which indicates that the market is still going through a phase of slowdown. When companies’ profits are not as good as expected, we have to be patient and learn to pay attention to what the market is doing.

4.Technological Advancement

New technology has changed a lot in recent years. Due to this, we can see decline in some sectors as well as growth of sectors. For example, Chatgpt has boosted the semiconductor sector.

The Role of Investor Sentiment

The sentiment of investors also plays a big role. Often the market falls only due to fear when the investors lose faith and wonder whether the market will fall further. Although it is difficult to accurately predict sentiment,But media- coverage such as economic reports and market performance can influence sentiment. In recent times, the rise of retail investors and online platforms has made the market more accessible but has increased the instability. For example, on social media platforms, both positive and negative emotions can be expressed by those who express their feelings. If investor sentiment begins to turn negative, it could cause a major decline in the market.The stock market crash of 2008 was very severe. At that time, the sentiment of investors was very negative.

Conclusion:-

The market has fallen 12% from its peak. But the American President’s tariff war has caused volatility in the market. RBI has cut the repo rate by 0.25% but still the interest rate has remained quite high. At Firstraid, we believe that there is nothing for stock market crash in the market right now but there is volatility which can cause concern for many investors. Finally, we believe that investing in a planned manner is the best way. Whether the market is up or down, with the right strategy and mindset, you can achieve your financial goals—no matter what the future holds for the stock market in 2025.

Read more: Biggest stock market crash

[…] Read More : Stock Market Crash-is it possible in 2025? […]

Excellent web site you’ve got here.. It’s difficult to find high quality

writing like yours these days. I truly appreciate people like you!

Take care!!

hello!,I love your writing very a lot! share we keep in touch more about your article on AOL?

I require an expert in this house to unravel my problem. Maybe that

is you! Having a look forward to peer you.

[…] is formed. These three candles together form a morning star. If such a pattern appears after a long downtrend it indicates a bullish […]